debt snowball worksheet pdf

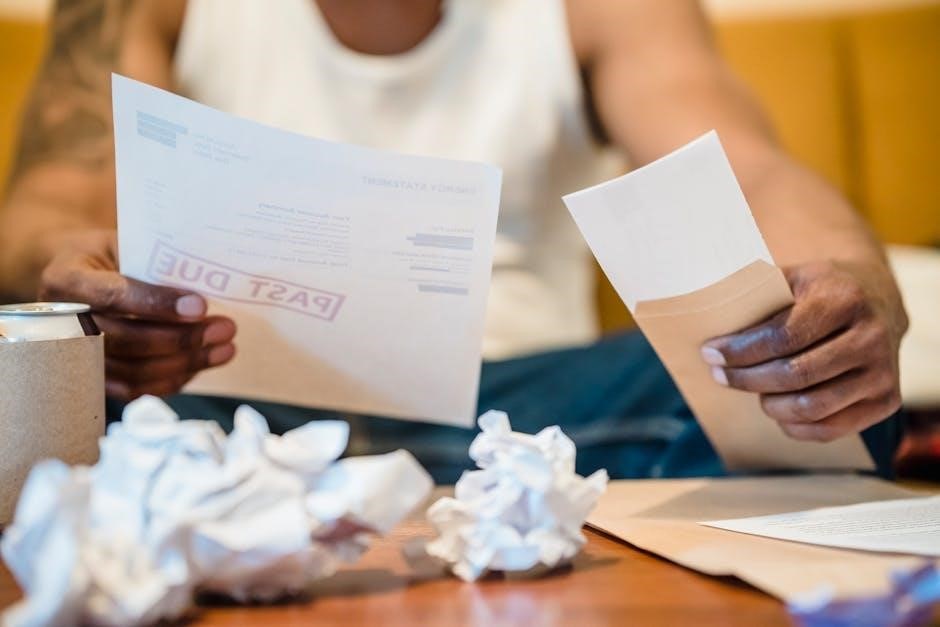

The Debt Snowball Method is a popular debt reduction strategy that focuses on paying off debts starting with the smallest balance first. Using a debt snowball worksheet PDF, individuals can organize their debts, track progress, and stay motivated throughout their journey to becoming debt-free. This approach emphasizes building momentum by celebrating small victories, which helps maintain motivation and discipline in achieving financial freedom. The method is simple, effective, and supported by tools like printable worksheets and spreadsheets, making it accessible to everyone.

1.1 What is the Debt Snowball Method?

The Debt Snowball Method is a straightforward debt reduction strategy where individuals pay off their smallest debts first, while making minimum payments on larger ones. Popularized by Dave Ramsey, this approach focuses on building momentum by quickly eliminating smaller balances, which provides psychological motivation. It involves listing all debts, sorting them by balance, and systematically attacking them. The method is often paired with a debt snowball worksheet PDF or spreadsheet to track progress, ensuring accountability and clarity. By concentrating on one debt at a time, users gain a sense of achievement, helping them stay committed to their financial goals.

1.2 Why Use the Debt Snowball Method?

The Debt Snowball Method is favored for its psychological benefits and simplicity. It provides quick wins by eliminating smaller debts first, boosting motivation and momentum. This approach helps individuals stay focused and encouraged throughout their debt repayment journey. By pairing it with a debt snowball worksheet PDF, users can track their progress visually, celebrate small victories, and maintain accountability. The method’s structure makes it easier to avoid feeling overwhelmed, as it breaks down the process into manageable steps. This makes it a powerful tool for achieving financial freedom and long-term stability.

Benefits of the Debt Snowball Method

The Debt Snowball Method offers a clear payoff plan, boosting motivation and momentum. It helps users stay organized, track progress, and maintain focus, leading to financial freedom.

2.1 Boosts Motivation and Momentum

The Debt Snowball Method excels at building motivation by providing quick wins. Paying off smaller debts first gives a sense of accomplishment, which fuels momentum. This psychological boost keeps individuals committed to their financial goals. Celebrating each paid-off debt, no matter how small, reinforces progress and encourages continued effort. The visible reduction in debt burdens motivates users to stay disciplined and focused on achieving financial freedom. This approach ensures that the journey remains encouraging and productive, helping individuals overcome debt more effectively.

2.2 Provides a Clear Payoff Plan

The Debt Snowball Method offers a structured approach to debt repayment, providing a clear and actionable plan. By organizing debts from smallest to largest, individuals can systematically tackle each obligation. The debt snowball worksheet PDF helps users visualize their progress, ensuring no debt is overlooked. This method creates a step-by-step roadmap, allowing individuals to focus on one debt at a time while making minimum payments on others. The clarity of this plan reduces financial overwhelm and provides confidence in achieving a debt-free future. It ensures every payment is purposeful and aligned with long-term goals.

2.3 Helps Track Progress Effectively

The Debt Snowball Method excels at tracking progress, ensuring accountability and motivation. A debt snowball worksheet PDF allows users to list all debts, monitor monthly payments, and update balances. This structured approach provides a clear visual of how much has been paid and what remains. By updating the worksheet regularly, individuals can see their progress, which reinforces their commitment to becoming debt-free. Celebrating each paid-off debt boosts morale, keeping users focused and driven to achieve financial freedom. This transparency makes the journey manageable and rewarding.

How to Implement the Debt Snowball Method

Start by listing all debts, sorting them by balance. Pay minimums on all except the smallest, which you attack with extra funds. Update your debt snowball worksheet PDF regularly to track progress and stay motivated as you eliminate each debt one by one.

3.1 Step 1: List All Your Debts

Begin by compiling a comprehensive list of all your debts in your debt snowball worksheet PDF. Include credit cards, loans, and any other obligations. For each debt, note the creditor, balance, interest rate, and minimum payment. This step ensures clarity and helps prioritize which debts to tackle first. Organizing your debts visually makes it easier to understand your financial situation and create a structured plan for elimination. Use the worksheet to maintain accuracy and track progress effectively as you move forward.

3.2 Step 2: Sort Debts by Balance

After listing all your debts in the debt snowball worksheet PDF, sort them from the smallest balance to the largest. This step is crucial for building momentum, as paying off smaller debts first provides quick wins and motivation. Ignore interest rates at this stage and focus solely on balances. Organizing your debts this way simplifies the process and helps you stay focused on your goals. Use the worksheet to clearly visualize your debt hierarchy and ensure you’re tackling them in the most effective order for psychological and financial progress. This step sets the foundation for your debt elimination journey.

3.3 Step 3: Pay Minimum Payments on All Debts

In the debt snowball worksheet PDF, after sorting your debts, make minimum payments on all debts except the smallest one. This step ensures you avoid late fees and protect your credit score while focusing extra funds on the smallest balance. By maintaining minimum payments, you prevent financial penalties and keep your credit in good standing. This foundational step allows you to allocate additional resources to the priority debt, accelerating its payoff. Use the worksheet to track these payments and stay organized as you progress through your debt elimination plan. Consistency is key to long-term success.

3.4 Step 4: Apply Extra Funds to the Smallest Debt

After covering minimum payments, allocate any extra funds to the smallest debt. This step accelerates its payoff, building momentum. Use the debt snowball worksheet PDF to track where extra payments are applied. By focusing on the smallest balance first, you quickly eliminate one debt, freeing up more money for the next. This approach creates a psychological boost, keeping you motivated. Ensure all extra income, such as bonuses or savings, goes toward this debt to pay it off faster. The worksheet helps visualize progress, making it easier to stay committed to your debt-free goal.

3.5 Step 5: Roll Over Payments to the Next Debt

Once the smallest debt is paid off, roll over the entire payment amount to the next smallest debt. This includes the minimum payment and any extra funds. The debt snowball worksheet PDF helps track this process, ensuring no payments are missed. By consolidating payments, you accelerate the payoff of subsequent debts, maintaining the momentum built from earlier successes; This step is crucial as it maximizes the impact of your payments, leading to faster debt elimination. The worksheet visualizes this rollover, making it easier to stay organized and focused on your financial goals.

Understanding the Debt Snowball Worksheet

A debt snowball worksheet PDF is a tool that helps organize and track debts, listing them from smallest to largest. It includes columns for balance, monthly payment, and progress, ensuring clarity and motivation as you pay off debts systematically. This worksheet is essential for staying on track and visualizing your journey toward becoming debt-free.

4.1 What is a Debt Snowball Worksheet?

A debt snowball worksheet is a tool designed to help individuals organize and track their debts systematically. It typically includes columns for listing debts, balances, interest rates, and monthly payments. The worksheet allows users to prioritize debts, focusing on paying off the smallest balances first while making minimum payments on others. By using a debt snowball worksheet PDF, users can visualize their progress, stay motivated, and maintain accountability throughout their debt repayment journey. This organized approach simplifies the process of becoming debt-free and ensures steady progress.

4.2 Key Features of a Debt Snowball Worksheet

A debt snowball worksheet typically includes columns for listing debts, balances, interest rates, and monthly payments. It allows users to sort debts by balance, prioritize payments, and track progress visually. Key features include automatic calculations for total debt, remaining balances, and payoff timelines. Many worksheets also provide space for noting extra payments and celebrating milestones. The debt snowball worksheet PDF is customizable, enabling users to tailor it to their specific financial situation. Its structured format helps maintain accountability and motivation, making the debt repayment process more manageable and transparent.

4.3 How to Use the Debt Snowball Worksheet PDF

To use a debt snowball worksheet PDF, start by downloading and printing the template. List all your debts, including balances, interest rates, and minimum payments. Sort the debts by balance, from smallest to largest; Each month, record your payments and update the remaining balances. Use the worksheet to track progress visually and stay motivated. The PDF format allows for easy customization, enabling you to add extra payments or notes. Regularly updating the worksheet helps maintain accountability and keeps you focused on your debt-free goal. This tool simplifies the debt snowball method, making it easier to follow and achieve success.

Variations of the Debt Snowball Method

Explore alternative strategies like the Debt Avalanche, which prioritizes high-interest debts, or a Hybrid Approach combining snowball momentum with avalanche savings. These variations offer tailored solutions for different financial situations.

5;1 Debt Avalanche Method

The Debt Avalanche Method is a strategic approach that focuses on paying off debts with the highest interest rates first, while making minimum payments on others. This method is mathematically efficient as it minimizes the total interest paid over time. Unlike the Debt Snowball, which prioritizes smaller balances for quicker wins, the Avalanche approach requires discipline but offers long-term financial savings. It’s particularly beneficial for those with high-interest debts, though it may lack the motivational boost of achieving rapid payoffs. Combining it with a debt snowball worksheet PDF can enhance tracking and organization.

5.2 Hybrid Approach: Combining Snowball and Avalanche

A Hybrid Approach blends the Debt Snowball and Avalanche methods, offering a balanced strategy. It prioritizes debts with the highest interest rates within smaller balance groups, combining mathematical efficiency with the motivational benefits of quick wins. This method allows individuals to save money on interest while maintaining momentum through early successes. By categorizing debts and addressing high-interest ones first within each group, the Hybrid Approach provides flexibility and customization. Using a debt snowball worksheet PDF can help track and organize this strategy effectively, ensuring progress and motivation throughout the debt repayment journey.

5.3 Debt Snowball Variation for Similar Balances

For debts with similar balances but varying interest rates, a Debt Snowball variation can be applied. This approach involves prioritizing debts with higher interest rates within the same balance group to minimize interest payments. While maintaining the motivational aspect of the snowball method, this strategy incorporates a practical twist to optimize financial savings. By focusing on higher-interest debts first within similar balance categories, individuals can reduce overall interest paid while still experiencing the satisfaction of quick wins. A debt snowball worksheet PDF can help organize and track this tailored approach effectively, ensuring both efficiency and motivation in debt repayment.

Creating Your Own Debt Snowball Spreadsheet

Creating a debt snowball spreadsheet helps track and manage debts systematically. It involves listing debts, adding formulas for calculations, and customizing the structure to fit individual needs, ensuring clarity and progress tracking.

6.1 Setting Up the Structure

Setting up the structure of a debt snowball spreadsheet begins with organizing essential columns like Debt Name, Balance, Interest Rate, and Monthly Payment. This layout ensures clarity and ease of tracking progress. Each debt is listed in ascending order of balance, aligning with the debt snowball method. Additional sections for payment history and balance updates help maintain accountability. Properly structuring the spreadsheet makes it user-friendly and effective for managing debt repayment. This clear organization is key to staying motivated and focused on financial goals.

6.2 Adding Formulas for Calculations

Adding formulas to your debt snowball spreadsheet automates calculations, saving time and reducing errors. Use the SUM function to calculate total monthly payments and remaining balances. For example, SUM(B2:B10) totals payments across debts. Conditional formatting highlights progress visually. Formulas like =IF(A2>0, “Active”, “Paid”) track debt status. These tools ensure accurate updates and clear insights into your debt payoff journey, making it easier to stay on track and motivated as you work toward financial freedom. Properly implemented formulas enhance the spreadsheet’s functionality and user experience.

6;3 Customizing the Worksheet to Your Needs

Customizing your debt snowball worksheet PDF ensures it aligns with your financial goals and preferences. You can add columns for interest rates, minimum payments, or due dates to enhance clarity. Tailor the layout by adjusting rows or columns to fit your debt list. Incorporate color-coding to highlight paid-off debts or emphasize high-priority accounts. Adding a progress bar or visual trackers can motivate you to stay on track. Personalize formulas to calculate totals or project payoff dates, making the worksheet a dynamic tool for your debt-free journey. Customize it to reflect your unique financial situation and goals.

Using Google Sheets for Debt Tracking

Google Sheets offers a flexible and collaborative way to track debt using the debt snowball method. Its real-time collaboration and automatic calculations make managing payments and progress seamless. With customizable templates, you can organize debts, set payment plans, and visualize your journey to becoming debt-free. Accessible from anywhere, Google Sheets is an ideal tool for maintaining accountability and staying motivated throughout your financial journey.

7.1 Benefits of Google Sheets for Debt Tracking

Google Sheets offers exceptional flexibility and collaboration for debt tracking. Its real-time updates and automatic calculations simplify managing payments and progress. Accessible from any device, it allows seamless sharing with partners or financial advisors. Customizable templates enable users to tailor spreadsheets to their needs, while built-in formulas automate complex calculations. This reduces errors and saves time. The ability to track multiple debts, visualize progress, and set reminders ensures accountability. These features make Google Sheets a powerful tool for effectively implementing the debt snowball method and staying motivated throughout the debt payoff journey.

7.2 Step-by-Step Guide to Setting Up a Debt Snowball Tracker

Start by opening Google Sheets and creating a new spreadsheet. Name it “Debt Snowball Tracker.” Add headers like “Debt Name,” “Balance,” “Monthly Payment,” and “Interest Rate.” List all your debts, sorting them by balance from smallest to largest. Include columns for tracking payments, remaining balances, and payoff dates. Use formulas to calculate totals and automate updates. Add a section for recording extra payments and a progress bar to visualize your journey. Regularly update the tracker to reflect payments and celebrate milestones. This setup helps you stay organized, motivated, and focused on your debt-free goal.

Printable Debt Snowball Worksheets

Download free Debt Snowball Worksheet PDF templates to organize and track your debt payoff journey. These printable tools help you list debts, monitor payments, and stay motivated with a clear plan.

8.1 Free Debt Snowball Worksheet PDF Templates

Download free Debt Snowball Worksheet PDF templates to streamline your debt payoff journey. These templates offer customizable columns for debt details, payment tracking, and progress visualization. They are designed to help you stay organized and motivated by breaking down your financial goals into manageable steps. Printable and easy to use, these worksheets are ideal for anyone looking to take control of their debt. Many templates also include space for noting interest rates, minimum payments, and extra contributions, making them versatile tools for achieving financial freedom. Find these templates online and start your debt-free path today.

8.2 How to Print and Use the Worksheets Effectively

Start by printing the Debt Snowball Worksheet PDF on high-quality paper for clarity. Fill in all your debts, from smallest to largest, including balances, interest rates, and minimum payments. Update the worksheet monthly to reflect progress, crossing off paid debts for motivation. Use the tracker to allocate extra funds to the smallest balance first, building momentum. Keep the worksheet in a visible spot to stay committed. Regular reviews ensure you stay on track, helping you achieve financial independence faster. This simple yet powerful tool makes debt management structured and rewarding.

Tracking Progress and Staying Motivated

Tracking progress with a debt snowball worksheet PDF helps maintain motivation. Regular updates provide a clear view of accomplishments, reinforcing commitment to financial goals and celebrating milestones effectively.

9.1 Celebrating Small Wins

Celebrating small wins is crucial for staying motivated during the debt repayment journey. The debt snowball worksheet PDF allows you to track each milestone, giving a sense of accomplishment as you eliminate debts one by one. Paying off the smallest balance first provides quick victories, boosting confidence and encouraging continued effort. Acknowledging these achievements helps maintain focus and reinforces the progress made. By visualizing success through the worksheet, you stay committed to your financial goals and build momentum toward a debt-free life.

9.2 Visualizing Your Debt Payoff Journey

Visualizing your debt payoff journey is a powerful motivator. The debt snowball worksheet PDF helps you see the big picture, breaking down your progress into manageable steps. By tracking each payment and reduction in balance, you can clearly see how close you are to eliminating each debt. This visual representation reinforces your commitment and provides a sense of accomplishment as you watch your debts shrink. The ability to see your progress firsthand keeps you focused and motivated, making the journey to financial freedom feel achievable and rewarding.

9.3 Sharing Your Goals with a Partner or Friend

Sharing your debt payoff goals with a partner or friend can significantly enhance your journey. By involving someone you trust, you create accountability and gain moral support. Discussing your progress with them ensures you stay committed to your plan. Using a debt snowball worksheet PDF together allows you to visualize and track your advancements side by side. This shared experience fosters teamwork and motivation, making the process less isolating. Open communication about your financial goals strengthens relationships and provides an added layer of encouragement to achieve a debt-free life.

Common Challenges and Mistakes

Common challenges include ignoring interest rates, not sticking to the plan, and overlooking emergency funds. These mistakes can hinder progress and delay debt repayment; Awareness is key.

10.1 Ignoring Interest Rates

Ignoring interest rates is a common mistake in the Debt Snowball Method. While focusing on smaller balances builds momentum, higher-interest debts can accumulate more costs over time. For instance, a credit card with a 20% APR will grow faster than a student loan with a 4% rate. By not prioritizing these, individuals may pay more in interest, prolonging their debt journey. Using a debt snowball worksheet PDF can help track interest rates, ensuring a more strategic approach to minimize overall interest paid and accelerate debt repayment.

10.2 Not Sticking to the Plan

Not adhering to the Debt Snowball Method is a significant mistake that can derail progress. Consistency is key to paying off debts systematically. Skipping payments or deviating from the plan can lead to prolonged payoff periods and increased interest accumulation. Using a debt snowball worksheet PDF helps maintain accountability and track progress, ensuring users stay on course. Without discipline, motivation may wane, and the journey to debt freedom becomes more challenging. Sticking to the plan is essential for achieving financial goals and avoiding further financial strain.

10.3 Overlooking Emergency Funds

Ignoring the need for an emergency fund is a critical mistake in the Debt Snowball Method. Unexpected expenses can derail progress, forcing individuals to accumulate more debt. A lack of savings leaves no cushion for emergencies, leading to further financial strain. While focusing on debt repayment is important, neglecting an emergency fund can undermine long-term success. Using a debt snowball worksheet PDF helps track expenses, but it’s equally vital to allocate part of your income to building a safety net. Without it, staying on the debt repayment plan becomes increasingly challenging, risking a cycle of debt that’s hard to escape.

Success Stories Using the Debt Snowball Method

Many individuals have achieved financial freedom by using the Debt Snowball Method. Real-life examples show how focusing on small wins builds momentum, helping people pay off debts systematically and stay motivated. Celebrating progress, even minor victories, keeps users engaged, leading to long-term success and a debt-free life. These stories inspire others to start their own journeys, proving the method’s effectiveness in transforming financial struggles into triumphs.

11.1 Real-Life Examples of Debt Snowball Success

Many individuals have shared inspiring stories of paying off debts using the Debt Snowball Method. One couple paid off $10,000 in credit card debt within a year by focusing on the smallest balances first. Another person eliminated $30,000 in student loans and personal loans in just three years. These success stories highlight how the method’s focus on quick wins builds momentum and motivation. By using a debt snowball worksheet PDF, they tracked progress, stayed organized, and celebrated milestones, proving the method’s effectiveness in achieving financial freedom. Their journeys inspire others to take control of their debt.

11.2 Lessons Learned from Successful Debt Payoff

Successful debt payoff using the Debt Snowball Method teaches valuable lessons. Many individuals emphasize the importance of discipline, consistent tracking, and celebrating small victories. Using a debt snowball worksheet PDF helps stay organized and motivated. A key takeaway is avoiding new debt while paying off existing balances. Another lesson is the psychological impact of quick wins, which keeps motivation high. Finally, patience and persistence are crucial, as debt repayment is a marathon, not a sprint. These insights inspire others to adopt similar strategies for achieving financial freedom and long-term stability.

The Debt Snowball Method, supported by a debt snowball worksheet PDF, offers a structured approach to achieving financial freedom. By organizing debts, tracking progress, and maintaining discipline, individuals can successfully eliminate debt and build a stronger financial future. This method’s focus on small wins and steady momentum makes it an effective and motivating strategy for those committed to becoming debt-free.

12.1 Final Thoughts on the Debt Snowball Method

The Debt Snowball Method is a powerful and motivating approach to debt elimination. By focusing on paying off the smallest debts first, individuals gain momentum and confidence. Printable debt snowball worksheet PDFs provide a clear structure for tracking progress, ensuring accountability and organization. This method emphasizes psychological wins, making it easier to stay committed. While it may not always prioritize high-interest debts, its ability to build motivation makes it a highly effective strategy for many. With dedication and the right tools, achieving financial freedom becomes attainable and rewarding.

12.2 Encouragement to Start Your Debt-Free Journey

Embracing the Debt Snowball Method is a courageous step toward financial freedom. By using a debt snowball worksheet PDF, you’ll gain clarity and control over your finances. Remember, every small payment brings you closer to your goal. Celebrate each milestone—it’s motivation to keep going. Stay disciplined, and watch your debts disappear one by one. The journey may seem long, but with persistence and the right tools, you’ll achieve a debt-free life. Start today and take the first step toward a brighter, stress-free future. Your financial freedom is worth the effort!